DeFi Arbitrage

DISCLAIMER

These is a page taken from the legacy documentation. It is here for historical purposes only.

Understanding the Price Discovery Mechanism of Asset Pairs in CLOBs & AMMs

The price of an asset pair in a Centralized Order Book (CLOB) and an Automated Market Maker (AMM) is determined differently. In a CLOB, the price is set by market makers who create buy and sell orders, and other participants can decide whether to trade at those prices.

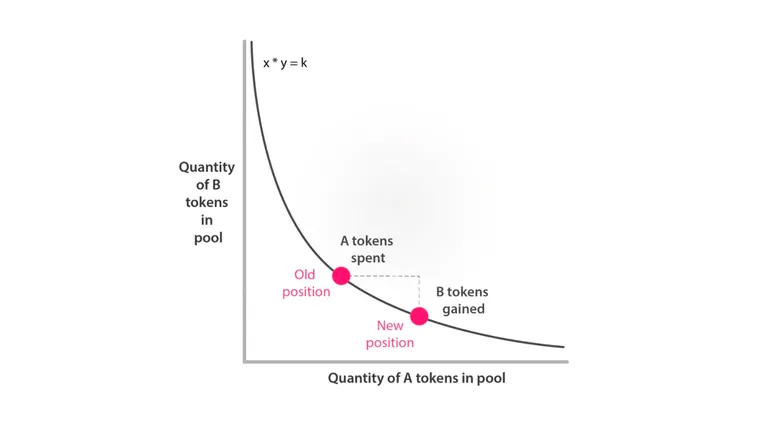

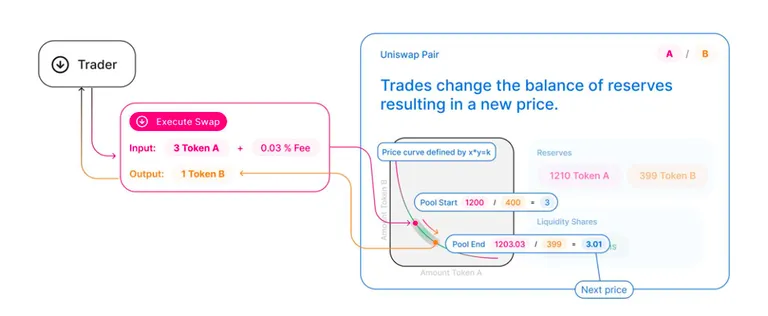

On the other hand, in an AMM, the price is determined using a mathematical formula that takes into account the balance of each asset deposited in the liquidity pool.

For example, Uniswap trading pools only allow two assets, and the price of the pair is determined by the formula x*y=k. This means that the price of the pair is determined by the balance of each asset in the pool.

The Consequence of Different Price Discovery Mechanisms

The different price discovery mechanisms in CLOBs and AMMs result in arbitrage opportunities. For example, there may be opportunities for arbitrage between a CLOB and an AMM, or even between two different AMMs (such as Raydium and Orca).

It is important to note that the only way for the price of an asset pair to change in an AMM is when a swap occurs. As a result, arbitrageurs play a crucial role in helping to keep the price of the asset pair close to other markets.

Additional Considerations

It is worth mentioning that some AMM protocols may allow users to add liquidity on only one side of the pool, which can affect the price of the asset pair. As a result, it is important to consider the specific AMM protocol and its rules when determining the price of an asset pair.

In conclusion, understanding the price discovery mechanisms in CLOBs and AMMs is crucial for traders and investors who want to make informed decisions about their trades.